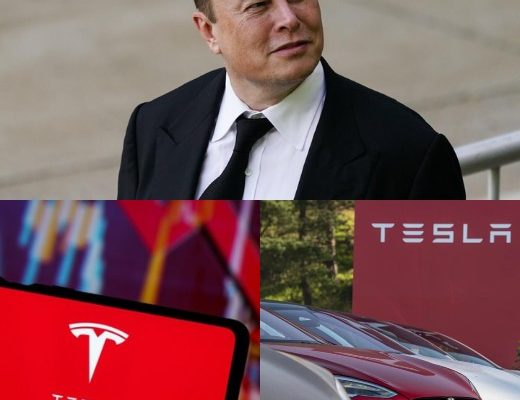

In what is shaping up to be one of the most turbulent quarters in Tesla’s history, the electric vehicle titan posted a shocking 71% drop in profits, signaling deeper tremors beneath the company’s glossy tech facade. The loss — a staggering $981 million decline year-over-year — is not only a brutal financial blow but a symbolic moment that suggests the global shine of Elon Musk may be beginning to tarnish.As Tesla stumbles, longtime markets are losing faith. Customers in China are turning their backs, European buyers are pulling away, and even Wall Street is bracing for impact. For the first time in years, the question is no longer just whether Tesla can deliver — it’s whether Elon Musk himself is becoming a liability.The dramatic earnings report came on April 22, when Tesla announced its net income for the first quarter of 2025 had plummeted to just $409 million, down from $1.39 billion during the same period the previous year. Revenue also took a hit, falling from $21.3 billion to $19.3 billion, while gross margins dipped from 17.4% to 16.3%.The figures were far below Wall Street expectations, and while a brief 5% bump in after-hours trading suggested some investor relief at Musk’s renewed focus on Tesla, it did little to offset a year-long stock nosedive exceeding 40%.The company’s CEO, Elon Musk, tried to downplay the crisis with characteristic bravado. On a call with analysts, he said the “major work” of establishing the Department of Government Efficiency (DOGE) — a controversial federal agency he helped lead — was now behind him.He pledged to return to Tesla full-time, allocating “far more of my time to Tesla” starting in May and spending only “a day or two per week on government matters.”Yet the market reaction was clear: the world is no longer as willing to take Musk at his word.Tesla’s troubles in China are especially concerning. Once the company’s most important international growth market, China has rapidly become hostile territory. Earlier this month, Tesla was forced to halt orders from mainland customers for two of its flagship models — the Model S and Model X — due to what the company described as “market conditions.”However, industry insiders point to deeper problems: increased competition, consumer backlash against Musk’s political stances, and waning trust in Tesla’s self-driving claims.Chinese EV giant BYD has launched a formidable challenge, debuting a next-gen battery that charges in mere minutes. Combined with national pride and state support, BYD’s rise has put real pressure on Tesla’s Shanghai operations. The once-loyal Chinese consumer base is migrating toward domestic alternatives that offer not only technological innovation but political neutrality.The fact that Tesla still produces the Model 3 and Model Y in Shanghai offers some buffer, but with nationalistic sentiment on the rise and foreign CEOs under increased scrutiny, the writing on the wall is hard to ignore.Meanwhile, Tesla’s position in Europe — once a reliable growth engine — is slipping. Musk’s controversial social media activity and vocal support for far-right figures in the region have alienated large swaths of consumers. What once made him a tech rockstar is now being perceived as erratic, polarizing, and in some cases, offensive.European automakers are also catching up. Legacy brands like Volkswagen, BMW, and Mercedes-Benz have accelerated their EV programs, introducing sleek models equipped with advanced tech, refined interiors, and competitive price points. No longer the only game in town, Tesla is being forced to defend its turf in a market that prizes both performance and politics.And as European regulators increase scrutiny on autonomous driving technology — including the very Full Self-Driving system Tesla is banking on — the continent appears to be losing interest in Musk’s futuristic promises.Domestically, Tesla is no longer the media darling it once was. The same week Tesla posted its near-billion-dollar shortfall, Musk doubled down on bold claims about the company’s autonomous driving ambitions. He reaffirmed Tesla’s plan to launch a paid robotaxi service in Austin by June, stating that “millions of Teslas will be operating autonomously in the second half of the year.” He even speculated that consumers would be able to “go to sleep in our cars and wake up at [their] destination” by year’s end.The problem? Federal regulators aren’t buying it. The National Highway Traffic Safety Administration (NHTSA) currently has multiple open investigations into Tesla’s Autopilot and Full Self-Driving features, following a string of accidents tied to the software’s behavior in poor visibility conditions.Critics have long accused Tesla of misleading branding, noting that Full Self-Driving is only partially autonomous and still requires human oversight. Auto analysts, like Sam Abuelsamid of Telemetry Insight, have publicly questioned Musk’s optimism: “The system is not robust enough to operate unsupervised,” he warned. “It will suddenly make mistakes that will lead to a crash.”Musk’s decision to continue pushing self-driving rhetoric — even as Tesla bleeds money and faces scrutiny — has prompted some analysts to wonder whether the CEO is out of touch with both reality and regulatory limits.Tesla’s loss is not just about numbers. It represents a broader shift in global sentiment. Once heralded as the visionary who could do no wrong, Musk is increasingly being seen as a risk — a man whose polarizing persona and political forays could be doing more harm than good to the brand he built.His pursuit of government influence through DOGE, combined with his divisive commentary on social issues, has transformed him from a universally admired innovator into a lightning rod for controversy.And while Tesla still has some financial levers — notably its lucrative sales of emissions credits, which brought in $595 million this quarter — the fundamentals are deteriorating. The company is also being hit by the Trump administration’s new tariffs, which will affect material imports and the company’s energy storage division. Even retaliatory trade actions from China are taking a toll.Investors are beginning to reckon with what some call “The Elon Effect” — the double-edged sword of having the world’s most high-profile CEO. While Musk’s charisma, risk-taking, and bold vision built Tesla’s global brand, that same high-voltage personality may now be repelling customers and partners alike. His time away from Tesla, spent slashing government programs and stirring political unrest through DOGE, only reinforced perceptions of distraction and disinterest.As one analyst put it off the record: “It’s not just that the numbers are down. It’s that people are starting to ask — is Elon Musk still good for Tesla?”Despite the grim headlines, Tesla isn’t finished. It still leads the U.S. EV market and maintains strong brand recognition. It’s working on a cheaper Model Y to revive sales and continues to generate significant cash flow, posting $2.2 billion this quarter versus just $242 million a year ago. These are not the figures of a company in freefall — but they are warning signs of a company teetering on the edge of transformation.Tesla can still recover — but doing so may require more than just Musk’s renewed attention. It may require a reckoning. A shift in culture, a reevaluation of public messaging, and perhaps even a redefinition of what leadership means in an era where innovation is no longer enough.For now, Tesla’s $981 million loss isn’t just a financial headline. It’s a global statement: the world is watching, and some are beginning to walk away.Whether Elon Musk can bring them back — or even wants to — remains to be seen.

URGENT UPDATE: Elon Musk’s fall from global darling to deserted CEO: Tesla lost $1,000,000,000, China dumped him, and Europe turned its back